Key Tokyo rubber futures fell from one-month highs on Friday (May 27), hurt by a stronger yen and growing concerns over the sovereign debt crisis in Europe and the growth outlook.

Key Tokyo rubber futures fell from one-month highs on Friday (May 27), hurt by a stronger yen and growing concerns over the sovereign debt crisis in Europe and the growth outlook.

FUNDAMENTALS

The benchmark contract on the Tokyo Commodity Exchange for November delivery, which debuted on Thursday (May 26), was down 4.4 yen or 1.1 percent to 387.0 yen per kg as of 0030 GMT.

The contract rose as high as 392.2 yen on Thursday (May 26), the highest for any benchmark since April 28, when firmer oil prices and rising Shanghai rubber futures helped support sentiment.

The most-active Shanghai rubber contract for September delivery rose 395 yuan to close at 32,690 yuan ($5,033.933) per tonne on Thursday (May 26).

Asian physical rubber prices were a little higher on Thursday (May 26), supported by rising futures prices in Tokyo and limited supply in producing countries, dealers said.

The euro remained under pressure on Friday (May 27) on mounting doubts Greece will receive the next round of aid from the International Monetary Fund and on global outlook concerns, while the dollar slid against the yen.

U.S. crude futures stood steady above $100 a barrel on Friday (May 27) after falling more than 1 percent a day earlier on weak U.S. economic data that raised worries about oil demand.

MARKET NEWS

The International Monetary Fund could withhold the next slice of aid to Greece due next month, the head of euro zone finance ministers said on Thursday, spooking markets with the possibility of default.

Unexpectedly weak consumer spending hobbled the U.S. economy in the first quarter and fresh signs of a slowdown in the labour market pointed to an uphill struggle for the recovery.

Honda Motor Co Ltd said its North American assembly plants will not reach full production until August for most vehicles, and it will take even longer for the high-volume Civic compact car.

Global natural rubber production was forecast to rise to 9.936 million tonnes in 2011, lower than a previous estimate of 10.025 million tonnes, due to output revisions in Indonesia and the Philippines, industry group ANRPC said on Thursday (May 26).

The Nikkei stock average edged lower on Friday as optimism over a rise in U.S. stocks was offset by a stronger yen.

U.S. stocks rose for a second day on Thursday (May 26) in a choppy session, with technology and consumer discretionary stocks leading the way after upbeat earnings.

Friday, May 27, 2011

Tokyo Futures Fall on Firmer Yen, Growth Worries

Spot rubber declines on buyer resistance

KOTTAYAM, MAY 27:

KOTTAYAM, MAY 27:

Physical rubber prices declined on Friday. Though there has been no visible selling pressure in the market as arrivals continued to be low, prices slipped on buyer resistance. Transactions were meagre.

The rubber market continues to be clouded by uncertainties according to the Association of Natural Rubber Producing Countries (ANRPC). Prices from mid-April onwards have been on the decline although at a slow pace on growing concerns about global economy, strengthening of Japanese yen and marginal drop in crude oil prices.

Sheet rubber surrendered to Rs 214 (217) a kg, according to traders. The grade moved down to Rs 215.50 (217) a kg both at Kottayam and Kochi, according to the Rubber Board.

The June series weakened to Rs 215.31 (216.51), July to Rs 219.27 (220.47), August to Rs 218.50 (219.91) and September to Rs 218 (218.55) while the October series improved to Rs 215.55 (213.50) and November to Rs 217.15 (214.00) a kg for RSS 4 on the National Multi Commodity Exchange.

The June futures inched up to ¥418 (Rs 232.99) from ¥417 a kg during the day session but then finished unchanged in the night session on the Tokyo Commodity Exchange. RSS 3 (spot) slipped to Rs 233.27 (233.32) a kg at Bangkok.

Spot rates were (Rs/kg): RSS-4: 214 (217); RSS-5: 212 (214); ungraded: 210 (212); ISNR 20: 207 (209) and latex 60 per cent 128 (130).

Source: http://www.thehindubusinessline.com/markets/commodities/article2054528.ece

Import of Synthetic Rubber in China - tons

| Source Country | During Apr-11 | % change from Apr-10 | Unit value ($/ton) | During Jan-Apr.11 | % change from Jan-Apr.10 | |||||

| South Korea | 26,375 | -29.1 | 3,283 | 112,548 | -20.6 | |||||

| Japan | 17,815 | -20.0 | 3,661 | 75,200 | -18.0 | |||||

| USA | 17,760 | -3.6 | 4,037 | 79,299 | 14.5 | |||||

| Russia | 13,810 | -47.8 | 4,095 | 48,851 | -43.3 | |||||

| Taiwan | 9,520 | -29.2 | 2,939 | 38,979 | -18.6 | |||||

| France | 5,514 | -19.1 | 3,669 | 19,068 | 13.5 | |||||

| Canada | 4,396 | 37.7 | 4,938 | 12,971 | 35.1 | |||||

| Germany | 3,610 | -47.6 | 2,925 | 21,891 | 8.7 | |||||

| Malaysia | 2,579 | -9.7 | 4,450 | 11,040 | 8.1 | |||||

| Belgium | 2,471 | -21.1 | 3,863 | 15,457 | -5.7 | |||||

| Britain | 2,355 | -16.0 | 3,438 | 11,490 | 21.8 | |||||

| Netherlands | 1,995 | -3.7 | 3,357 | 10,502 | 51.9 | |||||

| Mexico | 1,971 | 21.2 | 3,677 | 8,665 | 91.8 | |||||

| Italy | 1,903 | -18.5 | 2,965 | 6,241 | 18.0 | |||||

| Thailand | 1,785 | -53.1 | 2,845 | 9,734 | -41.8 | |||||

| Brazil | 894 | -2.9 | 3,213 | 2,672 | -47.4 | |||||

| Iran | 750 | -28.2 | 3,565 | 3,080 | -49.7 | |||||

| UAE | 342 | 3,830 | 997 | |||||||

| Singapore | 321 | -32.7 | 4,481 | 1,000 | -37.1 | |||||

| Spain | 279 | -87.4 | 2,338 | 898 | -84.7 | |||||

| Indonesia | 242 | 114.3 | 1,110 | 2,048 | -52.0 | |||||

| Hongkok | 141 | -48.2 | 3,149 | 817 | -3.7 | |||||

| Others | 1,472 | |||||||||

| Total | 118,300 | -27.1 | 3,621 | 503,337 | -14.8 |

Source: Customs Department, Government of China

Note: Synthetic latex grades are accounted in wet weight

China: Shanghai Warehouse Rubber Stocks Down 26.2 Percent

Rubber inventories in warehouses monitored by the Shanghai Futures Exchange fell 26.2 percent from last Friday, the exchange said on Friday (May 27).

Changes in metals stocks are reported as follows:

DELIVERABLE ON WARRANT

(Reuters, May 27, 2011)

Europe: Truck sales continue recovery

Brussels – Registrations of new commercial vehicle registrations increased by 9.5 percent across the EU in April, according to new data from ACEA, the European federation of vehicle makers.

Brussels – Registrations of new commercial vehicle registrations increased by 9.5 percent across the EU in April, according to new data from ACEA, the European federation of vehicle makers.

Among the major markets, only France (-3.0 percent) and Spain (-14.3 percent) declined while Germany (+12.2 percent) and the UK expanded (+23.6 percent). From January to April, a total of 657,707 new vehicles were registered, or 13.5 percent more than over the same period a year ago. France (+7.7 percent) recorded the most vehicles (161,941 units), followed by the UK (104,190) and Germany (103,020) which grew by 28.6 percent and 25.5 percent respectively.

Heavy truck (over 16t) sales continued to accelerate, with sales reaching 20,581 new heavy trucks in April. All major markets posted strong growths, leading to an overall 52.4 percent upturn in the region. The British market expanded by 72.7 percent, followed by the Netherlands (+62.1 percent), France (+47.8 percent), Spain (+32.5 percent) and Germany (+31.5 percent).

From January to April, 78,624 new trucks were registered in the EU, or 61.9 percent more than in the same period last year. Germany (+50.9 percent) was the biggest market, recording 19,860 units, while France (+62.8 percent) ranked second with 13,369 new vehicles. The Netherlands (+40.6 percent) and Spain (+40.7 percent) performed similarly. The UK saw its demand increase by 79.9 percent.

The same picture emerged in mid-sized trucks (3.5t – 16t) with 27,338 new vehicles regitered in the EU in April, posting a 42.4 percent increase compared to the same month a year earlier. Growth prevailed across countries, ranging from +56.7 percent in the Netherlands to +48.8 percent in the UK, +40.1 percent in France, +31.3 percent in Germany and +28.9 percent in Spain.

Over the first four months, the most significant markets performed similarly as demand for new trucks grew by 36.2 percent in the Netherlands, 40.8 percent in Spain, 43.3 percent in the UK, 45.4 percent in Germany and 52.2 percent in France. Overall, new truck registrations increased by 48.7 percent, totaling 103,935 units.

Sales of vans (up to 3.5t) also increased, but much more slowly. In April, demand for new vans were up 4.6 percent** in the EU*, amounting to 127,814 units. Of the most significant markets, France (-6.6 percent) and Spain (-19.0 percent) faced a downturn, while new registrations increased in Germany (+5.1 percent) and the UK (+21.4 percent).

Four months into the year, new van registrations totaled 543,030 units, or 8.9 percent more than in the first four months of 2010. France was the largest market and expanded by 4.5 percent. Germany (+18.9 percent) and the UK (+29.0 percent) both posted a double-digit growth, while Spain saw its market contract by 11.3 percent.

Once again, sales of buses and coaches declined. Registrations slipped by 0.3 percent in April as the Spanish (+56.7 percent) and German (+14.4 percent) markets expanded while new registrations were down in France (-18.3 percent) and the UK (-10.7 percent).

From January to April, the EU* recorded 10,742 new buses and coaches, or 1.3 percent less than in the same period in 2010. The UK and France remained the largest markets despite a downturn of 28.2 percent and 13.6 percent respectively. The German market was stable (+0.5 percent), while the Spanish expanded by 66.4 percent.

Due to the unavailability of data from Italy since January 2011, figures reported for that country are an extrapolation made by data provider AAA. They are not actual market figures, hence the possibility of an error margin with regard to the EU totals. Italy usually accounts for 10 to 15 percent of the EU Commercial Vehicle market.

Source: european-rubber-journal.com

NMCE, India: Rubber up, castor seed down Friday

MUMBAI (Commodity Online) : On Friday, till5 pm, National Multi Commodity Exchange of India ltd (NMCE) traded in 18 Commodities. The total volume is 13842 lots with a turnover of Rs.438.26 crores.

MUMBAI (Commodity Online) : On Friday, till5 pm, National Multi Commodity Exchange of India ltd (NMCE) traded in 18 Commodities. The total volume is 13842 lots with a turnover of Rs.438.26 crores.

RUBBER FUTURES traded with a total volume of 7632 lots and a turnover of 165Crs. 88Lakhs. The Total Open interest in all series was 5412.June Series lost Rs.120 at LTP at the end of today's first session at Rs.21531.00. July Series lost Rs.120 at LTP at the end of today's first session at Rs.21927.00. September Series lost Rs.55 at LTP at the end of today's first session at Rs.21800.00. August Series lost Rs.141 at LTP at the end of today's first session at Rs.21850.00. October Series gained Rs.205 at LTP at the end of today's first session at Rs.21555.00. November Series gained Rs.315 at LTP at the end of today's first session at Rs.21715.00

CASTOR SEED 10 MT FUTURES traded with a total volume of 244 lots and a turnover of 11Crs. 97Lakhs. June Series lost Rs.49 at LTP at the end of today's first session at Rs.4859.00

RAPE/MUSTARD SEED FUTURES traded with a total volume of 966 lots and a turnover of 24Crs. 53Lakhs. June Series lost Rs.4.7 at LTP at the end of today's first session at Rs.503.30

NICKEL FUTURES traded with a total volume of 4 lots and a turnover of 10Lakhs. June Series lost Rs.0.3 at LTP at the end of today's first session at Rs.1057.00. July Series gained Rs.1 at LTP at the end of today's first session at Rs.1061.00

COPPER FUTURES traded with a total volume of 172 lots and a turnover of 7Crs. 09Lakhs. June Series lost Rs.0.15 at LTP at the end of today's first session at Rs.412.45. August Series lost Rs.0.8 at LTP at the end of today's first session at Rs.417.00

ZINC FUTURES traded with a total volume of 788 lots and a turnover of 40Crs. 46Lakhs. May Series lost Rs.0 at LTP at the end of today's first session at Rs.99.50. June Series lost Rs.0.7 at LTP at the end of today's first session at Rs.102.00

LEAD FUTURES traded with a total volume of 308 lots and a turnover of 17Crs. 58Lakhs. June Series lost Rs.0.95 at LTP at the end of today's first session at Rs.113.25

GOLD FUTURES traded with a total volume of 26 lots and a turnover of 58Lakhs. June Series lost Rs.18 at LTP at the end of today's first session at Rs.22357.00

SACK FUTURES traded with a total volume of 752 lots and a turnover of 33Crs. 88Lakhs. June Series gained Rs.36 at LTP at the end of today's first session at Rs.3641.00

RAW JUTE FUTURES traded with a total volume of 768 lots and a turnover of 25Crs. 61Lakhs. May Series lost Rs.0 at LTP at the end of today's first session at Rs.3304.60. June Series lost Rs.15.9 at LTP at the end of today's first session at Rs.3321.50

COFFEE REP BULK FUTURES traded with a total volume of 6 lots and a turnover of 10Lakhs. May Series lost Rs.0 at LTP at the end of today's first session at Rs.11180.00

CHANA FUTURES traded with a total volume of 508 lots and a turnover of 12Crs. 81Lakhs. June Series lost Rs.17 at LTP at the end of today's first session at Rs.2505.00

GUARGUM FUTURES traded with a total volume of 44 lots and a turnover of 4Crs. 54Lakhs. June Series gained Rs.103.5 at LTP at the end of today's first session at Rs.10464.50

GUARSEED 10 MT FUTURES traded with a total volume of 142 lots and a turnover of 4Crs. 70Lakhs. June Series gained Rs.32 at LTP at the end of today's first session at Rs.3347.00

ISABGULSEED FUTURES traded with a total volume of 498 lots and a turnover of 27Crs. 11Lakhs. June Series gained Rs.54 at LTP at the end of today's first session at Rs.5459.40. August Series gained Rs.55 at LTP at the end of today's first session at Rs.5567.40

SOYOIL 10 MT FUTURES traded with a total volume of 612 lots and a turnover of 39Crs. 81Lakhs. June Series lost Rs.6.45 at LTP at the end of today's first session at Rs.644.05

ALUMINIUM 5 TON FUTURES traded with a total volume of 370 lots and a turnover of 21Crs. 44Lakhs. June Series lost Rs.1.1 at LTP at the end of today's first session at Rs.114.80

GOLD GUINEA FUTURES traded with a total volume of 2 lots and a turnover of The Total Open interest in all series was 62. May Series lost Rs.0 at LTP at the end of today's first session at Rs.17865.00

Source: http://www.commodityonline.com/news/Rubber-up-castor-seed-down-Friday-at-NMCE-39417-3-1.html

Apollo Tyres open to buying rubber plantations: MD

NEW DELHI: Apollo Tyres Ltd is open to the possibility of buying rubber plantations to fight surging rubber prices that have been eroding tyre makers' margins, a top executive said on Friday.

NEW DELHI: Apollo Tyres Ltd is open to the possibility of buying rubber plantations to fight surging rubber prices that have been eroding tyre makers' margins, a top executive said on Friday.

"As far as buying rubber plantations, or for that matter any kind of backward integration, is concerned, we are always open to possibilities depending upon the need of the hour," Neeraj Kanwar , vice-chairman and managing director, told in an e-mailed response.

The tyre maker is reviewing contracts with suppliers to correct rubber prices, and also maintaining a leaner and efficient inventory and working towards greater production efficiency to deal with higher prices of rubber, a key raw material for tyre, he said.

Thursday, May 26, 2011

Global Tire Demand Exceeding Supply Helps Bridgestone, Goodyear, Sumitomo

Global tire demand is expanding at a faster pace than production, led by growth in China, as vehicle sales are increasing, Sumitomo Rubber Industries Ltd. (5110) said.

Global tire demand is expanding at a faster pace than production, led by growth in China, as vehicle sales are increasing, Sumitomo Rubber Industries Ltd. (5110) said.

Tire sales in China, the world’s largest auto market, may increase 30 percent this year, or at 10 times the global rate, President Ikuji Ikeda said in an interview. Sumitomo Rubber, the largest Japanese tiremaker after Bridgestone Corp. (5108), said sales will increase 3.1 percent to 93.7 million tires this year.

Rubber prices climbed 38 percent in the past year and reached a record in February after auto sales in China surged 32 percent in 2010 to an all-time high, surpassing the U.S. market for a second year. Increasing costs spurred tiremakers from Bridgestone to Akron, Ohio-based Goodyear Tire & Rubber Co. to raise prices. Commodities beat stocks, bonds and the dollar for five straight months through April, prompting central banks from Beijing to Brasilia to raise interest rates to cool inflation.

“Tire supply/demand is tight globally and particularly in North America,” Goldman Sachs Group Inc. analysts including Yuichiro Isayama said. “In contrast to many makers that retrenched due to the financial crisis, Bridgestone and Sumitomo Rubber increased capacity and are benefitting from growth in demand amid a global supply shortage,” they said May 12.

Bridgestone shares advanced 24 percent in the past year and traded at 1,825 yen in Tokyo today, while Sumitomo Rubber shares increased 15 percent to 923 yen.

China Sales

While auto sales in China reached a record 18 million last year, they slowed in 2011 as the nation increased retail gasoline and diesel prices and tightened monetary policy to cool the fastest inflation since 2008. The government increased interest rates and raised bank reserve-ratio requirements to curb price gains that have exceeded the government’s 4 percent target every month this year. Demand for replacement tires is growing in China as car ownershipexpands, Ikeda said.

Sumitomo Rubber, which controls about 6 percent of the global tire market, said it can process 46,000 tons of rubber a month this year, up 3.5 percent from last year. The Kobe-based company said May 17 it is building a plant in Brazil that will have a capacity of 2,200 tons a month by 2013 and is also expanding production capacity in Thailand and China.

“Our production capacity is not large enough to meet expanding demand,” Ikeda said in Tokyoon May 25. “The shortage may worsen” as global consumption is expected to grow by 3 percent annually in coming years, he said.

Tire Demand

Global sales of passenger-car tires are forecast to grow 6.1 percent this year from 2010, while sales of commercial- vehicle tires are forecast to rise 11 percent, International Rubber Study Group forecast on Jan. 26.

Natural-rubber production in key growing countries may miss estimates this year as output slows in the second quarter, the Association of Natural Rubber Producing Countries said yesterday. Production from member countries, representing 92 percent of global supply, may expand 4.9 percent, less than the 5.8 percent forecast last month, the group said in an e-mailed report.

Rubber futures in Tokyo tumbled to 335 yen a kilogram ($4,098 a metric ton) on March 15 from a record high of 535.7 yen reached on Feb. 18. The March 11 earthquake and tsunami disrupted supplies of car parts, forcing Toyota Motor Corp. and rivals to slash output and stoking concerns that tire demand from automakers will weaken. Futures traded at 387.3 yen at 1:06 p.m. local time.

Pre-Quake Level

The disaster will reduce tire sales for new cars in Japan by about 2 million units from March to June, Ikeda said. The loss may be recouped in the second half of this year as automakers step up efforts to restore production, he said.

“Some of the carmakers may return their production to pre- quake levels by July,” Ikeda said.

The company plans to use 505,000 tons of natural and synthetic rubber this year for tire production, gaining 6.5 percent from last year. Natural rubber represents more than half of the volume, said Shizuma Kubota, general manager at Sumitomo Rubber’s public relations department.

More than 80 percent of the natural rubber used by the company is technically specified rubber, which is cheaper and easier to process than ribbed-smoked-sheet rubber, Ikeda said.

Technically specified rubber for June delivery on the Singapore Exchange closed at $4.62 a kilogram yesterday. The price reached a record $5.75 on Feb. 10 amid speculation the supply shortage may worsen after heavy rains disrupted output in Thailand, Indonesia and Malaysia -- the top-three producers.

Seasonal Increase

Ribbed-smoked-sheet rubber for June delivery on the Singapore bourse closed at $5.14 a kilogram yesterday, retreating from a record $6.488 reached on Feb. 17.

The company expects to buy so-called TSR-20 rubber at $5.5 a kilogram on average for the second quarter of this year, $5.2 for the third quarter and $5 for the fourth quarter as a seasonal increase in supply from Thailand, the world’s largest producer and exporter, will put a drag on prices.

“I don’t expect the price will exceed $6,” Ikeda said. Supply will also increase as trees planted five to seven years ago in Southeast Asia will become available for tapping, he said.

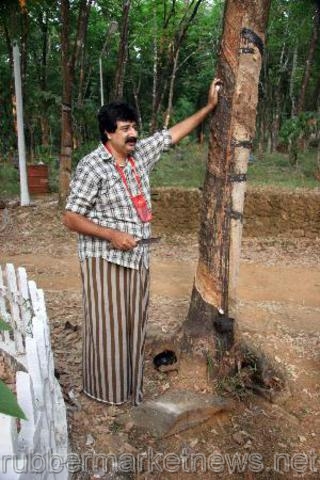

Growth of global NR output to decline in Q2: ANRPC

![rubbermarketnews_078_640x419[1] rubbermarketnews_078_640x419[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjwWljKoHjkQbLLbTJw60W2m868Az10cGNzhhwJZ2IzJr9Pw-4K4fHJylC_T9sT8yRT5Q68ebQlOTcrApy4lsoTc0XPgwnO2aHKl_y8KACotHASLnFpWHMNPlbvtTPF01DvQBU2zN0xkoE/?imgmax=800)

ANPRC revealed the forecast in the May issue of its publication, Natural Rubber Trends & Statistics. This covers historical data from February 2011, and forecasts for the coming months.

The group said output from its member countries in the first quarter of 2011 is expected to reach 2.348 million tonnes, up 10.1 percent from the figure of 2.133 million tonnes in 2010 and 1.79 million tonnes in 2009.

For the second quarter, ANRPC said total production by its members would be 2.205 million tonnes, up by 5.8 percent from the figure of 2.084 million in 2010 and up from 2.054 million tonnes in the second quarter of 2009.

The output growth during the full year 2011 now stands revised down further to 4.9 percent from 5.8 percent forecasted a month before and 6.4 percent growth attained during the year before. The new revision results from a down-scaling of Indonesia’s anticipated production for the year, to 2.891 million tons from 2.972 million tons expected a month before. Philippines also has downscaled the output anticipated for this year, to 107,000 tons from its earlier forecast of 114,000 tons.

As a result of these revisions, this year’s total output from all ANRPC nations is expected at 9.936 million tons only as against 10.025 million tons previously expected and 9.472 million tons produced during 2010.

The organisation said its forecasts are based partly on reduced demand from China. “China’s Import of NR, including rubber compounds having very high NR-contents, has been on the decline after March this year. Import fell to 261,000 tons in April from 280,000 tons in March. Preliminary estimate indicates the possibility of import falling further to 245,000 tons in May and 235,000 tons in June. (An expected 27.5 percent year-to-year rise during Q2 this year reflects the very low volume imported during the same quarter in the previous year).” /p>

China’s consumption of NR, including rubber compounds having very high NR-contents, is anticipated to fall 2.8 percent, year-to-year, in Q2 (April-June) this year.

Source: http://www.european-rubber-journal.com/fullitem.aspx?id=115708

Rubber prices to depend on Japan’s recovery

Though future of rubber prices are encouraging, Chairman of Balangoda Plantations PLC (BALA) Harry Jayawardena said, all depends on factors such as the change in global weather patterns, and Japan’s recovery.

Jayawardena in his review for the financial year ended in 31 December 2011 said, tensions spreading across the Middle East will also affect future of Rubber prices. In the lately published annual report of Balangoda Plantations PLC, Jayawardena goes on to explain that the country’s rubber production has recorded an increase of 16 million kilogrammes during 2010, in spite of unfavourable weather conditions experienced during the 3rd and the 4th quarters in the Sabaragamuwa District.

“Rubber prices have been at better levels last year,” Jayawardena notes adding that the main driving force being emerging economies of China and India where car production leapfrogged. “There were instances when the price of Sheet Rubber exceeded the premium grades of Crepe in 2010, which was mainly due to the increased rubber demand for tyre and automobile industries.”

Source: http://print.dailymirror.lk/business/127-local/45146.html

Tokyo futures at 1-month high

BANGKOK: Tokyo rubber futures rose to a one-month high on Thursday on the back of firmer oil prices and rising Shanghai rubber futures, but profit-taking limited the gains, dealers said.

BANGKOK: Tokyo rubber futures rose to a one-month high on Thursday on the back of firmer oil prices and rising Shanghai rubber futures, but profit-taking limited the gains, dealers said.

The newly launched benchmark contract on the Tokyo Commodity Exchange for November delivery rose 2.5 yen to settle at 391.4 yen ($4.773) per kg. It rose as high as 392.2 yen, the highest since April 28.

"Players, as well as investment funds, resumed buying contracts again after seeing a rise in other commodities, while strongerShanghai futures provided additional support," said a Tokyo-based trader.

The most-active Shanghai rubber contract for September delivery rose 395 yuan to finish at 32,690 yuan ($5,033.933) per tonne.

Brent crude rose above $115 a barrel on Thursday due to a softer dollar and an unexpected drop in US distillate stocks, which overshadowed gains in gasoline and crude inventories.

However, dealers said small players took profit when prices broke above 390 yen per kg, capping further rises.

Dealers said TOCOM rubber could rise further on Friday after finishing above the key resistance of 390 yen, but the rise was seen as capped, with players still cautious about recent rises.

Source: http://www.brecorder.com/top-news/111-markets-top-news/15358-tokyo-futures-at-1-month-high.html

Tokyo Futures Rise On Higher Oil, Share Prices

Tokyo rubber futures climbed early on Thursday (May 26) as a rebound in oil prices to two-week highs and rises in share prices brightened market sentiment.

Tokyo rubber futures climbed early on Thursday (May 26) as a rebound in oil prices to two-week highs and rises in share prices brightened market sentiment.

FUNDAMENTALS

The key Tokyo Commodity Exchange rubber contract for November delivery, which debuted on Thursday (May 26), stood at at 389.1 yen per kg as of 0040 GMT.

The previous benchmark contract for October delivery was up 9.3 yen, or 2.4 percent, at 395.1 yen, after settling up 2.6 percent on Wednesday at 385.8 yen ($4.709) per kg. That was the highest since May 19 and above resistance of 385 yen.

The May TOCOM rubber futures contract expired at 408.0 yen per kg on Wednesday (May 25), down 9.7 percent from the April contract's 451.6 yen expiry price.

Deliveries against the May rubber contract fell 21 percent from April, to 241 lots or 1,205 tonnes, the exchange said on Wednesday (May 25).

The most active Shanghai rubber contract for September delivery rose 680 yuan to finish at 32,295 yuan ($4,969.555) per tonne on Wednesday (May 25).

Oil prices rose 2 percent on Wednesday (May 25), climbing to two-week highs as an unexpected drop in U.S. distillate inventories trumped a sharp rise in gasoline stocks and as a softer dollar supported fresh commodities buying.

The dollar rose 0.1 percent to 81.98 yen against the yen. The euro came under further pressure against the dollar as investors fretted about Greece's ability to repay its debts.

MARKET NEWS

Delphi Automotive filed to raise up to $100 million in an initial public offering, the U.S. auto supplier said in a securities filing on Wednesday (May 25), less than two years after emerging from bankruptcy.

Electric car maker Tesla Motors Inc plans to raise up to $214 million through a share offering to help fund development of its Model X SUV, and said its chief executive would buy a portion of those shares.

The Nikkei stock average gained on Thursday (May 26), bouncing off a two-month closing low hit the previous day, helped by a rise in Wall Street shares and commodity prices, though market players said it was too early to say risk reduction has run its course.

U.S. stocks ended a three-day losing streak on Wednesday (May 25) as recent underperformers led a thinly traded rally that wasn't seen as strong enough to overcome worries about waning global demand.

(Reuters, May 26, 2011)

India: Spot rubber rules steady

KOTTAYAM, MAY 26:

KOTTAYAM, MAY 26:

Spot rubber finished unchanged on Thursday. Market activities were dull as there were no active participants, on either side, to set a definite trend. Major manufacturers were seen almost inactive.

According to traders, sheet rubber was steady at Rs 217 a kg amidst scattered transactions. The grade dropped to Rs 217 (217.50) a kg both at Kottayam and Kochi, according to Rubber Board.

The June series weakened to Rs 216.56 (218.43), July to Rs 220.50 (221.67) and August to Rs 219.63 (220.69) while the September series firmed up to Rs 218.50 (217.47) a kg for RSS 4 on the National Multi Commodity Exchange.

RSS 3 improved at its June futures to ¥417 (Rs 230.97) from ¥409 a kg during the day session but then remained inactive in the night session on the Tokyo Commodity Exchange. The grade (spot) increased to Rs 233.32 (231.17) a kg at Bangkok.

Spot rates were (Rs/kg): RSS-4: 217 (217); RSS-5: 214 (214); ungraded: 212 (212); ISNR 20: 209 (209) and latex 60 per cent: 130 (130).

Source: http://www.thehindubusinessline.com/industry-and-economy/agri-biz/article2051833.ece

NR prices remain unchanged

Tokyo -- Prices on Tokyo’s rubber exchanges eased slightly overnight.

Tokyo -- Prices on Tokyo’s rubber exchanges eased slightly overnight.

On Tokyo's Tocom Exchange, prices for the six-month contract eased by about yen 1, trading at yen 387 ($4.73) per kg on Thursday 26 May. Shorter-dated prices moved up slightly, trading at around 413.

In Singapore, SGX said short-dated RSS3 were trading up by 4 cents at around $5.14 with longer-dated contracts up by around $0.10 at around $4.98. Short-dated TSR 20 was trading up at $4.60.

In India, the NMCE saw June deliveries ease slightly, to close at around Rs218.4 ($4.82) per kilo

In China, the Shanghai Futures Exchange also saw prices rise by a fraction of a yuan, with June deliveries trading at around Yuan 34.8 ($5.36) per kilo.

Source: http://www.european-rubber-journal.com//fullitem.aspx?id=115705

ANRPC Cuts 2011 Global Natural Rubber Output To 9.936 Million Ton

Global natural rubber production was forecast to rise to 9.936 million tonnes in 2011, lower than a previous estimate of 10.025 million tonnes, due to output revisions in Indonesia and the Philippines, industry group ANRPC said on Thursday (May 26).

Global natural rubber production was forecast to rise to 9.936 million tonnes in 2011, lower than a previous estimate of 10.025 million tonnes, due to output revisions in Indonesia and the Philippines, industry group ANRPC said on Thursday (May 26).

This was ANRPC's second downward revision of its estimate for this year's output. Production of members of the Association of Natural Rubber Producing Countries reached 9.47 million tonnes in 2010.

"The output growth during the full year 2011 now stands revised down further to 4.9 percent from 5.8 percent forecast a month before and 6.4 percent growth attained during the year before," the ANRPC said in a report.

"The new revision results from a down-scaling of Indonesia's anticipated production for the year to 2.891 million tons, from 2.972 million tonnes expected a month before. Philippines also has downscaled the output anticipated for this year to 107,000 tonnes, from its earlier forecast of 114,000 tonnes."

ANRPC members include Thailand, Indonesia, Malaysia as well as Cambodia, China, India, Papua New Guinea, the Philippines Singapore, Sri Lanka and Vietnam, accounting for 92 percent of global output.

The group also accounts for 92 percent of global exports and 48 percent of global consumption of natural rubber.

Physical prices have dropped almost 20 percent since hitting a lifetime high at $6.40 in February, driven by futures selling on the Tokyo Commodity Exchange and worries about a drop in demand from China as it tightens monetary policy.

(Reuters, May 26, 2011)

ANRPC Announces the Release of Natural Rubber Trends & Statistics for May 2011

![ANRPC[1] ANRPC[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgregvpdpTxu3BjCFWAczdEDdxBWezxddndR6TKZeRRUVsvaypOqaYBhGx3hOhHSuDvXrwla0oTxZcl0ijj20dfhDMo3APHzWoB1qluTvWZaEwvxCUTSpBw9FybCB6ILGa6l4w3Cyxfetw/?imgmax=800)

Export seen rising 5.2% in Q2

China’s import declines

Thai Baht and Malaysian ringgit turn unfavourable to NR

Yen supports natural rubber

Crude oil impacts on natural rubber

Trends in natural rubber prices

21 Statistical Tables (Providing data and estimates up to May 2011 and forecasts for June & July 2011 covering 11 countries accounting for 92% of the global supply of natural rubber)

The publication is available only to paid subscribers. Annual subscription fee is RM 1,000 only (335 US dollar) for 12 monthly issues from January to December 2011.

For further details, please contact the ANRPC Secretariat at

Email: anrpc.secretariat@gmail.com or secretariat@anrpc.org

Fax: +60 3 2161 3014

Phone: +60 3 2161 1900

Asian Physical Rubber Prices On May 26

Asian physical rubber prices were a little higher on Thursday (May 26), supported by rising futures prices in Tokyo and limited supply in producing countries, dealers said.

PRICES OF PHYSICAL RUBBER COMPARED TO MAY 25

NOTE - The prices quoted above are offer prices collected from traders in Thailand, Indonesia and Malaysia. They are not official prices quoted by state-run rubber agencies in those countries.

(Reuters, May 26, 2011)

Wednesday, May 25, 2011

Tokyo futures at 1-week high

BANGKOK: Tokyo rubber futures rose 2.6 percent to a one-week high on Wednesday on the back of firm Shanghai futures, but gains were capped by profit-taking, dealers said.

BANGKOK: Tokyo rubber futures rose 2.6 percent to a one-week high on Wednesday on the back of firm Shanghai futures, but gains were capped by profit-taking, dealers said.

The benchmark rubber contract on the Tokyo Commodity Exchange for October delivery rose 9.9 yen, or 2.6 percent, to settle at 385.8 yen ($4.709) per kg, the highest since May 19.

The nearby May contract expired on Wednesday, finishing 2.9 yen higher at 408.0 yen

"TOCOM prices rose further on speculative buying as players took their cue from rising Shanghai futures," said a Tokyo-based dealer.

The most active Shanghai rubber contract for September delivery rose 680 yuan to finish at 32,295 yuan ($4,969.555) per tonne.

Traders said TOCOM gains were capped by profit-taking as players saw oil prices weaken.

Brent crude futures slipped below $112 a barrel on Wednesday after industry data showed US crude inventories fell less than forecast last week and as the dollar rebounded against the euro.

Dealers said they expected TOCOM prices to rise further on Thursday after the benchmark finished above resistance at 385 yen

Source: http://www.brecorder.com/top-news/111-markets-top-news/15261-tokyo-futures-at-1-week-high.html

Supply Concerns Boost Rubber

Rubber advanced for a second day as persistent rain across southern Thailand, the world’s largest producer, disrupted tapping, raising supply concerns.

Rubber advanced for a second day as persistent rain across southern Thailand, the world’s largest producer, disrupted tapping, raising supply concerns.

The October-delivery contract climbed as much as 2.7 percent to $385.9 yen per kilogram ($4,703 per metric ton) on the Tokyo Commodity Exchange before settling at 385.8 yen.

“Buying momentum continues as the market is concerned over the supply situation in southern Thailand,” said Chaiwat Muenmee, an analyst at commodity broker DS Futures Co.

Monsoon rains were spread across the Andaman Sea and the Gulf of Thailand, covering about 40 percent of southern Thailand, according to the Rubber Research Institute of Thailand.

Farmers in Southeast Asia resumed harvesting after the traditional February-to-May low-production season. Output from the region’s major producers, which represent 92 percent of global supply, may climb 10.5 percent to 2.3 million tons in the three months through June, the Association of Natural Rubber Producing Countries said in a monthly report in April.

The decline in rubber stockpiles in Japan is supporting prices, raising speculation that the country will soon replenish inventories, said Hiroyuki Kikukawa, general manager of research at IDO Securities Co.

Crude rubber stockpiles held at Japanese warehouses fell 0.7 percent to 8,112 tons as of May 10, according to data from the Rubber Trade Association of Japan.

Further gains in rubber prices are likely to be limited as demand from China, the biggest buyer, remains low, said Chaiwat.

“Chinese buyers seem to wait for prices to fall before building up inventories.”

Bloomberg

Source: http://www.thejakartaglobe.com/business/supply-concerns-boost-rubber/443171

Asian Physical Rubber Prices On May 25

Asian physical rubber prices were steady on Wednesday (May 25) despite bullish futures prices in Tokyo and Shanghai as thin demand on the physical front weighed on the market, dealers said.

Most buyers stayed on the sidelines, expecting prices to dip as supply rises in coming weeks, they said.

PRICES OF PHYSICAL RUBBER COMPARED TO MAY 24

| Grade |

| Price |

| Change |

| Thai RSS3 (June) | $5.10/kg | unchanged | ||

| Thai STR20 (June) | $4.55/kg | unchanged | ||

| Malaysia SMR20 (June) | $4.55/kg | unchanged | ||

| Indonesia SIR20 (June) | $2.05/lb | unchanged | ||

| Thai USS | 145 baht/kg | +5 baht | ||

| Thai 60-percent latex (drum/June) | 3,300/tonne | unchanged | ||

| Thai 60-percent latext (bulk/June) | $3,200/tonne | unchanged |

NOTE - The prices quoted above are offer prices collected from traders in Thailand, Indonesia and Malaysia. They are not official prices quoted by state-run rubber agencies in those countries.

(Reuters, May 26, 2011)

India: Lack of buyers weakens spot rubber

KOTTAYAM, MAY 25:

KOTTAYAM, MAY 25:

Spot rubber weakened on Wednesday. The market continued to shed the gains as there were no positive signals to trigger an uptrend either from the domestic or international scene. There has been selling from dealers and growers but the trading volumes were low in the absence of quantity buyers on any grade.

Sheet rubber declined to Rs 217 (218) a kg according to traders. The grade slipped to Rs 217.50 (218.50) a kg both at Kottayam and Kochi, according to the Rubber Board.

The June series concluded the session at Rs 218.40 (218.87), July at Rs 221.65 (221.82), August at Rs 220.50 (220.85), September at Rs 217.08 (216.70), October at Rs 210 (212.25) and November at Rs 214 (211) a kg for RSS 4 on the National Multi Commodity Exchange.

The key Tokyo rubber futures bounced back in tune with other commodities, while market participants kept a close eye on Shanghai futures to assess the demand from China.

The May futures for RSS 3 expired at ¥408 (Rs 225.52) a kg while the June futures improved to ¥409 (Rs 226.03) from ¥403.5 during the day session and then to ¥414 (Rs 228.79) a kg in the night session on the Tokyo Commodity Exchange. RSS 3 (spot) closed at Rs 231.17 (230.25) a kg at Bangkok.

Spot rates were (Rs/kg): RSS-4: 217 (218); RSS-5: 214 (216); ungraded: 212 (213); ISNR 20: 209 (211) and latex 60 per cent: 130 (131).

Source: http://www.thehindubusinessline.com/industry-and-economy/agri-biz/article2048732.ece

NR prices rebound

Tokyo -- Prices on Tokyo’s rubber exchanges rose once more overnight.

Tokyo -- Prices on Tokyo’s rubber exchanges rose once more overnight.

On Tokyo's Tocom Exchange, prices for the six-month contract increased by about yen 8, trading at yen 388 ($4.73) per kg on Wednesday 25 May. Shorter-dated prices remained unchanged, trading at around 412.

In Singapore, SGX said short-dated RSS3 were trading up by 2 cents at around $5.10 with longer-dated contracts down slightly at around $4.89. Short-dated TSR 20 was trading up at $4.54.

In India, the NMCE saw June deliveries rise by Rs 2, to close at around Rs219 ($4.82) per kilo

In China, the Shanghai Futures Exchange also saw prices rise by a fraction of a yuan, with June deliveries trading at around Yuan 34.5 ($5.31) per kilo

Source: http://www.european-rubber-journal.com/fullitem.aspx?id=115676

State-of-the-art tire rubber helps save fuel

Mumbai, Maharashtra, May 25, 2011 /India PRwire/ -- At a time when natural resources are becoming ever scarcer, the efficiency with which our vehicles transfer the engine's propulsion energy to the road plays an increasingly important role. Tires, which serve as the link between the engine and the asphalt, naturally play a key part. On freeways, tires currently account for around a fifth of fuel consumption, and in urban traffic, this figure can be as high as 30 percent. Specialty chemicals company LANXESS, a pioneer in the field of synthetic rubber, already markets rubber raw materials that can substantially reduce these figures. Examples include new grades of butyl rubber (IIR), modified solution styrene-butadiene rubber (SSBR) and advancedneodymium-polybutadiene rubber (Nd-BR).

Mumbai, Maharashtra, May 25, 2011 /India PRwire/ -- At a time when natural resources are becoming ever scarcer, the efficiency with which our vehicles transfer the engine's propulsion energy to the road plays an increasingly important role. Tires, which serve as the link between the engine and the asphalt, naturally play a key part. On freeways, tires currently account for around a fifth of fuel consumption, and in urban traffic, this figure can be as high as 30 percent. Specialty chemicals company LANXESS, a pioneer in the field of synthetic rubber, already markets rubber raw materials that can substantially reduce these figures. Examples include new grades of butyl rubber (IIR), modified solution styrene-butadiene rubber (SSBR) and advancedneodymium-polybutadiene rubber (Nd-BR).

"Developing new grades of tire rubber that help save energy but at the same time offer an equally high level of safety is a task for experienced chemists," says Christoph Kalla, head of Marketing & Research in the Performance Butadiene Rubbers business unit at LANXESS, "because some of the key properties of a tire are very difficult to optimize without impairing others. For example, it used to be a big problem to improve rolling resistance - a measure of the energy loss through the tire - without impairing abrasion resistance and wet grip. Thanks among other things to our many years of experience in this sector, rubber chemists have nevertheless made very good progress towards "squaring the circle". We anticipate that the rolling resistance of the next tire generation can be lowered by up to 10 percent merely by using currently available high-performance grades of tire rubber. Naturally without having to make any compromises on vehicle safety - quite the opposite in fact!"

The cause of high rolling resistance may be high internal friction of tire components. The "expander cord" effect can also play a part: If a rubber contains too many molecules with loose ends, it cannot make optimal use of the energy. These loose ends, much like torn expander cords, contribute virtually nothing to transmitting forces in the tire, yet they still have to be moved along.

It should be possible, for example, to reduce the internal friction of the silica gel filler particles that give the rubber its stability with the help of modified SSBR rubber from LANXESS. Expressed in layman's terms, the molecules of these rubber raw materials have a high density of "sticky" anchor points that stick particularly well to the hard filler particles and basically cover them with a thick, friction-reducing rubber skin. This "wrapping-up" of the silica gel particles optimizes the polymer/filler network, and this should have a positive effect on road grip and abrasion. Initial laboratory and practical tests indicate that tires made of these materials not only have good rolling resistance, they also give outstanding grip. On top of that, they have a very long service life.

The number of "loose ends" in the rubber matrix is, in turn, much lower in Nd-BR rubber from LANXESS than in other grades of tire rubber. What's more, because of complex physical relationships (more specifically, a narrow molecular weight distribution), producers can now manufacture tires with outstanding physical data using rubber raw materials that are also easier to process than before. At the same time, the latest grades of Nd-BR rubber from LANXESS result in more uniform, homogeneous products than many polybutadiene rubber types of former generations.

Finally, largely air-impermeable grades of LANXESS butyl rubber help keep tire pressure constant for a longer time. New IIR grades from LANXESS can, through their higher isoprene content, be vulcanized better than present products in the manufacturer's portfolio.

"These are just three recent examples from the LANXESS range," says Kalla. "We never stop subjecting our products to further development. We have dedicated ourselves to rubber, and our business success is therefore closely linked to our acknowledged innovative strength in this field." Another topical focus of R&D is specifically varying the molecular microstructure of styrene-polybutadiene tire rubber. New catalysts and increasingly sophisticated process engineering will help to further lower the rolling resistance of new high-performance tires, and thus help to extend, for example, electric vehicles' range, at the same time making them safer.

"However," continues Kalla, "the term 'sustainability' should not be reduced solely to the question of fuel consumption. Avoiding waste, for instance, is another important aspect of sustainability." Here, too, modern, high-performance grades of Nd-BR rubber from LANXESS offer a number of advantages: For example, they cushion confrontations with curbs better than many other rubber materials, which means that not only do they enhance safety, they also avoid waste. On the subject of life expectancy and mileage, LANXESS also has special tire rubber masterbatches in its portfolio that make the retreading of tires easier. That also saves valuable raw materials. Finally, the use of particularly abrasion-resistant grades of rubber in the tread contributes to good environmental performance, because they not only extend the service life of the tire, they also help reduce the fine dust problems in our towns and cities.

Notes to Editor

About LANXESS

LANXESS is a leading specialty chemicals company with sales of EUR 7.1 billion in 2010 and currently around 15,500 employees in 30 countries. The company is at present represented at 46 production sites worldwide. The core business of LANXESS is the development, manufacturing and marketing of plastics, rubber, intermediates and specialty chemicals.

Forward-Looking Statements.

This news release may contain forward-looking statements based on current assumptions and forecasts made by LANXESS AG management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. The company assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments.

ANALYSIS: Could global butadiene prices be set to fall?

The global butadiene market is currently enjoying record high prices, with the US Gulf Coast, Europe and Asia all trading at previously unseen price levels in recent weeks.

The global butadiene market is currently enjoying record high prices, with the US Gulf Coast, Europe and Asia all trading at previously unseen price levels in recent weeks.

Yet there were signs of a potential fall in the global value of butadiene as Asian sources reported weakening Chinese demand this week, while there were fears in the US Gulf Coast market that imported natural rubber demand could dampen previous strong demand for butadiene.

All three major regions have been trading at all-time highs. For the week ending May 20 spot CIF US Gulf Coast prices closed at 192.50 cents/pound ($4,232/mt). This compared with a spot price of 108 cents/lb on May 21, 2010, when the market was also considered as tight. In Europe, the FOB Rotterdam market closed at Eur2,795/mt ($3,932/mt) Tuesday versus Eur1,695/mt this time last year. Meanwhile the FOB Korea market was valued at $3,799/mt at close May 20, $1,598/mt higher than the same time last year.

But sources in Asia have recently begun to report a slowdown in Chinese buying, with demand falling from the onset of May as the market has become well-supplied, said local sources. An end-user was offered a 1,500 mt spot cargo from Sinopec Maoming for about $3,450-3,500/mt CFR China last week and there were few parties interested in the parcel. The spot cargo was in the market for more than a week, the end-user said.

Olefinscan delivers weekly analyses and pricing from key olefins markets around the world. Track the performance of spot and contract prices for ethylene, propylene, butadiene, raffinate-1, crude C4, and ethylene, and monitor plant operations to gain the valuable market intelligence you need to make critical decisions.

A trader added: "Korean producers are looking for up to $4,000/mt, but in China it is much lower. Producers are offering at $3,400/mt FOB China. The only domestic demand in China is from distributors, not end-users. Up until May, Chinese buying was at maximum capacity, but it is now totally different to that."

According to sources the downturn in buying in China has been brought on by the cash liquidity crisis in the country, which has reduced credit facilities of buyers.

Market participants say that the slowdown in demand is caused by lower cash flow and loan availability in the Chinese financial system. China has implemented various steps -- including raising interest rates and banks' reserve rate ratios -- to tame inflation.

"There are less loans available now," said a producer. "And buyers are holding off from buying."

Other sources felt that the high price of butadiene has also played a part in the Chinese slowdown. One source said: "[Acrylonitrile butadiene styrene] producers can't cover the cost of butadiene and butadiene rubber producers can't cover the costs either. Only styrene butadiene rubber producers are ahead. Surely that means a fall in June and July."

The lack of Chinese buying has not weakened other Asian markets however, thanks to strong global demand from both the US Gulf Coast and Europe. This has lead to the FOB Korea market to be price on a net back to the US.

Prices climbed last week with Korean producers selling at $3,700/mt and $3,800/mt FOB Korea. Both parcels were bought by traders moving product to the US sources said.

There has been no sign of any fall from those levels, and one Korean producer said this week: "Deep sea offers to the US are still at $3,700-3,800/mt FOB Korea and we have already sold out our spot product for June."

The producer acknowledged, however, that "China is still not good," but said that any potential downturn in Asian butadiene prices would be a reaction to the US -- not local markets.

The producer said: "I think [forward price direction] depends on the US market. There are still many traders seeking butadiene for the US. If the US market becomes bearish then the recent high prices will adjusted downward. But for July, the US market is still good," the producer said.

Other Korean producers acknowledged that should they be forced to sell locally prices would drop significantly without the support of the US market.

One producer said: "I feel the last FOB deal prices, could be the ceiling. A big gap exists between Asia and out-of-Asia. So almost all the Korean producers focus on out of Asia. If the deep sea market closes, then the [FOB Korea] butadiene price will adjust."

The outlook for the US was mixed with one US butadiene source saying the spot price in the US is "holding right now, but it's definitely not going up."

According to sources the demand for butadiene in the US has been muted somewhat by fears that imported rubber from Asia could dampen demand for butadiene in the US. "There are some real concerns that finished rubber from Asia -- if enough is sent to the US -- will make it impossible for [US butadiene converters] to pass on the higher butadiene prices." one converter said.

Butadiene derivative SBR can be used as a replacement for natural rubber, in areas such as tire manufacturing. For much of the year to date, natural rubber pricing has been higher than butadiene, stoked by fears of a global shortage or product.

According to sources, TSR (technically specified rubber) grades 10 and 20 are the most likely rubber grades to be replaced by butadiene in relevant applications. For much of the year to date natural rubber prices have been at a premium to butadiene, a factor which also helped create record high butadiene prices.

TSR20 prices touched $6,000/mt, following a spike which began during the final quarter of 2010. Although the Singapore commodity exchange value for TSR20 rubber futures for June 2011 closed at $4,542/mt May 24, there had previously been a drop in prices to as low as $3,500/mt, also caused by a fall in Chinese demand.

One natural rubber trader explained: "There has been some availability from China, where demand has been reduced by the cash liquidity crisis. Because of this, there has been some exports of local product to the US. China consumes 30-35% of natural rubber produced, so even a 10% reduction in demand can make a big impact."

Despite this, there appeared no widespread fall in demand from US buyers. One Korean producer said Friday: "I've got several bids from the US for early July and prices were also rising according to sources.

The US spot price for butadiene last week was assessed at 182.50 cents/lb CIF USG, about 40 cents above the May contract price. A source this week said the spot price was approaching 200 cents/lb ($4,408/mt), but was unlikely to go much higher because of the potential demand destruction caused by imported Asian rubber.

Looking ahead although natural rubber production was picking up according to sources, one trader believed that Chinese buying would increase in June and said: "I think we are at the bottom of the downwards trend."

US butadiene consumers who buy on a contract basis, though, could expect higher prices in June though. No June nominations were heard in the US market as of Thursday, though speculation was for a 10 to 15 cent increase, which would push the US butadiene contract as high as 160 cents/lb.

European prices also remained strong this week as supply tightness meant that consumers were competing with the US for spot butadiene cargoes.

One end-user was offered a 3,500 mt parcel for $4,000/mt from Haldia, India, arriving early June, but had turned it down as current requirements were fulfilled by contract cargoes. On Thursday, the European spot market was placed at about Eur2,700/mt ($3,854).

In addition, European traders were also able to take advantage of US demand and prices.

Low crude C4 supplies in the US are also drawing the butadiene feedstock away from Europe. Early May, the Nordic Gas loaded a mixed butadiene/raffinate/CC4 cargo from Northwest Europe to the US Gulf while at the end of May, the Maersk Humber will load 9,000-10,000 mt of crude C4 from Aliaga, bound for Houston.

Source: http://www.platts.com/RSSFeedDetailedNews/RSSFeed/Petrochemicals/8923459

Vietnam Rubber Exports Forecast at 40,000 Tons in May

Vietnam, the fourth-biggest rubber exporter in 2010, may ship 40,000 metric tons this month, according to figures today from the General Statistics Office in Hanoi.

Vietnam, the fourth-biggest rubber exporter in 2010, may ship 40,000 metric tons this month, according to figures today from the General Statistics Office in Hanoi.

The nation shipped 36,000 metric tons in April, 20 percent lower than a previous assessment of 45,000 tons, revised figures from the Statistics Office show. Exports in the first five months were 240,000 tons, up 31 percent from a year earlier.

Source: http://www.bloomberg.com/news/2011-05-25/vietnam-rubber-exports-forecast-at-40-000-tons-in-may.html

Tuesday, May 24, 2011

Tire, O-ring, auto parts production rises in China

BEIJING (May 24, 2011)—Production of radial tires in China in the first three months of 2011 increased by 8.7 percent, O-ring output jumped 35 percent and automotive antivibration products manufacturing rose more than 45 percent, according to the China Rubber Industries Association.

BEIJING (May 24, 2011)—Production of radial tires in China in the first three months of 2011 increased by 8.7 percent, O-ring output jumped 35 percent and automotive antivibration products manufacturing rose more than 45 percent, according to the China Rubber Industries Association.

Overall, tire exports increased slightly in the first quarter, rising to 40.9 percent of total tire production, the CRIA said. Total tire output rose by 5 percent, but this includes the impact of a 14- percent reduction in output of bias-ply tires.

The CRIA said profitability in China’s rubber industry continues to decline because of the increased prices of raw materials.

Source: http://www.rubbernews.com/subscriber/email.html?id=1306262597

Tokyo Futures Rise On Firmness In Other Commodities

Key Tokyo rubber futures rose on Wednesday (May 25), tracking other commodities higher, while market participants kept a close eye on Shanghai futures to gauge demand from China, the world's top consumer of rubber.

Key Tokyo rubber futures rose on Wednesday (May 25), tracking other commodities higher, while market participants kept a close eye on Shanghai futures to gauge demand from China, the world's top consumer of rubber.

FUNDAMENTALS

The benchmark rubber contract on the Tokyo Commodity Exchange for October delivery rose 6.6 yen or 1.8 percent to 382.5 yen per kg as of 0019 GMT.

The May contract will expire later on Wednesday (May 25), and the benchmark will switch to November delivery from Thursday (May 26).

Some dealers have said they expect futures to rise after the price finished above resistance at 370 yen on Tuesday (May 24).

The most active contract on the Shanghai rubber market for September delivery rose 785 yuan to settle at 31,615 yuan ($4,860.174) per tonne on Tuesday (May 24).

Oil prices were lower in early Asia on Wednesday (May 25) after rising 2 percent the day before in choppy trading when Goldman Sachs raised its price forecasts for Brent crude, saying demand from economic growth will eat into stockpiles and OPEC spare capacity.

The euro rose against the dollar in early Asia on Wednesday (May 25) following a slight relief rally across most markets after Monday's (May 23) widespread sell-off. Investors are encouraged by Spain's successful short-term debt offering and better-than-expected data from Germany and the United States.

MARKET NEWS

Japan's exports fell 12.5 percent in April from a year earlier, pushing the country into its first trade deficit in three months, Ministry of Finance data showed on Wednesday (May 25), after the earthquake in March disrupted supply chains and hurt output.

The volume of Japan's customs-cleared crude oil imports fell 14.0 percent in April from the same month a year earlier, the Ministry of Finance said on Wednesday (May 25).

Federal Reserve officials on Tuesday (May 24) expressed confidence in the U.S. economic recovery despite high gas prices and European financial jitters, and one suggested the U.S. central bank could reverse its ultra-loose monetary policy this year.

JK Tyre and Industries is looking to acquire a rubber plantation to offset rising input costs that are eroding the tyre maker's profits, a top official said on Tuesday (May 24).

Japan's benchmark Nikkei stock average opened up 0.16 percent.

U.S. stocks dipped in light volume on Tuesday (May 24) as lingering concerns about a slowdown in growth more than offset gains in energy shares.

(Reuters, May 25, 2011)

Indonesia: Govt told to better fund rubber producers

The government needs to better fund small plantations and improve planting policies to boost Indonesia’s rubber production, according to an international industry group.

The government needs to better fund small plantations and improve planting policies to boost Indonesia’s rubber production, according to an international industry group.

Lekshmi Nairm a senior economist with the International Rubber Study Group, said on Monday that Indonesia’s rubber output per hectare was still far lower than other rubber producers in Southeast Asia, such as Malaysia and Thailand.

“If some level of capital assistance for small holdings is given through different government policies, as has already implemented in the cases of Thailand and Malaysia, then surely [local producers] can increase productivity and Indonesia can be a leading producer,” she said on the sidelines of the Asian Commodities and Derivatives Conference 2011 in Jakarta.

Lekshmi said that Indonesia also needed to improve implementation of its plantation revitalization scheme.

According to recent information from the Indonesian Rubber Association (Gapkindo), Indonesian plantations produce an average of 880 kilograms of rubber per hectare every year, or about half of output of plantations in Thailand or India, which can produce more than 1,500 kilograms.

Gapkindo executive director Suharto Honggokusumo said the government’s revitalization program had failed to help small plantations to raise output since the scheme’s implementation in 2007.

Small scale rubber plantations comprise 86 percent of Indonesia’s rubber plantations, while 14 percent are controlled by private and state-owned firms.

“Many farmers could not access the funds because most of them did not have the required land certificates as collateral,” he said.

The government revitalization program covered Indonesia’s three main commodities — oil palm, rubber and cacao.

Under the program, the government allocated Rp 4.4 trillion (US$514.8 billion) between 2007 and 2010 for interest-subsidized investment loans to be issued by seven state-owned banks, including Bank Mandiri and Bank Rakyat Indonesia.

The scheme was aimed at, among other things, opening 1.5 million hectares of new plantations, including 1.3 million hectares of oil palm plantations, 50,000 hectares of rubber plantations and 110,00 hectares of cacao plantations.

However, only 6,000 hectares of new rubber plantations have been opened under the program.

Suharto said the low productivity of Indonesian plantations could be partly attributed to the use of low-yield, poor quality clones and improper tapping and planting techniques.

“The problem lies in the poor education of our farmers and their poor purchasing power,” he said, adding that around 40 percent of rubber farmers still used poor quality clones.

Indonesia is currently the world’s second largest producer of natural rubber after Thailand. The nation’s rubber plantations, located principally in Sumatra, Java and Kalimantan, are slated to produce 3.08 million tons of rubber this year, up 8 percent from 2.85 million tons last year. World rubber production for 2011 has been estimated to top 10 million tons.

Source: http://www.thejakartapost.com/news/2011/05/25/govt-told-better-fund-rubber-producers.html

NR prices rebound

Tokyo -- Prices on Tokyo’s rubber exchanges rose once more overnight.

Tokyo -- Prices on Tokyo’s rubber exchanges rose once more overnight.

On Tokyo's Tocom Exchange, prices for the six-month contract increased by about yen 13 , closing at yen 380($4.64) per kg on Tuesday 24 May. Shorter-dated prices also moved up, closing at 412.3.

In Singapore, SGX said short-dated RSS3 were trading up by 6 cents at around $5.08 with longer-dated contracts up further at around $4.90. Short-dated TSR 20 was trading up at $4.48.

In India, the NMCE saw June deliveries trading at around Rs217 ($4.80) per kilo

In China, the Shanghai Futures Exchange also saw prices rise by around one yuan, with June deliveries trading at around Yuan 34.14 ($5.25) per kilo

Source: http://www.european-rubber-journal.com/fullitem.aspx?id=115636

Tokyo futures rise 2 percent

BANGKOK: Tokyo rubber futures ended 2 percent higher on Tuesday, supported by a recovery in oil prices and firmness in other commodities, dealers said.

BANGKOK: Tokyo rubber futures ended 2 percent higher on Tuesday, supported by a recovery in oil prices and firmness in other commodities, dealers said.

The benchmark rubber contract on the Tokyo Commodity Exchange for October delivery rose 8.0 yen, or 2.1 percent, to settle at 375.9 yen ($4.587) per kg.

Some dealers said they expected TOCOM to rise further on Wednesday after the price finished above resistance at 370 yen.

The most active contract on the Shanghairubber market for September delivery rose 785 yuan to settle at 31,615 yuan ($4,860.174) per tonne.

Despite that small rise, rubber traders said the market was still concerned that global demand could be falling.

"Rubber sentiment improved, tracking a recovery in oil and rising gold, but the rises were still limited," said a Tokyo-based trader.

Brent crude futures rose to $110.77 a barrel on Tuesday, rebounding from the previous day's sharp fall as the prospect of strong oil demand trimming inventories overrode concerns about Europe's debt crisis.

Source: http://www.brecorder.com/top-news/111-markets-top-news/15153-tokyo-futures-rise-2-percent.html

Asian Physical Rubber Prices on May 24

Asian physical rubber prices were steady at relatively high levels on Tuesday (May 24), supported by firm prices on the Tokyo and Shanghai futures exchanges and limited supply in producing countries, dealers said.

PRICES OF PHYSICAL RUBBER COMPARED TO MAY 23

NOTE - The prices quoted above are offer prices collected from traders in Thailand, Indonesia and Malaysia. They are not official prices quoted by state-run rubber agencies in those countries.

(Reuters, May 24, 2011)

Tokyo Futures Inch Up, But Uncertain Demand Limits Gains

Key Tokyo rubber futures inched higher early on Tuesday (May 24) after heavy selling the previous day, but weaker oil prices and further signs of a slowdown in China, the world's top rubber consumer, limited gains.

Key Tokyo rubber futures inched higher early on Tuesday (May 24) after heavy selling the previous day, but weaker oil prices and further signs of a slowdown in China, the world's top rubber consumer, limited gains.

FUNDAMENTALS

The key Tokyo Commodity Exchange rubber contract for October delivery was up 0.6 yen, or 0.2 percent, at 368.5 yen as of 0030GMT.

The most active Shanghai rubber contract for September delivery fell 655 yuan on Monday (May 23) to settle at 30,830 yuan ($4,748.128) per tonne.

The dollar was flat against the Japanese currency, but spiked to a two-month high against the euro as economic worries in Greece, Spain and Italy fanned renewed risk aversion.

U.S. crude oil fell by $1.05 to $96.65 per barrel in early Asian trade on Tuesday (May 24) on a stronger dollar due to renewed concerns over euro zone debt.

MARKET NEWS

South Korea's Hyundai Motor has stopped production of diesel engines at its Ulsan plant due to a protracted strike from component supplier Yoosung Enterprise, Yonhap news reported on Tuesday (May 24).

Toyota Motor Corp and cloud computing company Salesforce.com Inc will build a social network service that will enable owners to become "friends" with their cars and get tweet-like reminders for maintenance checks and other notices.

U.S. drivers enjoyed the biggest one-week drop in gasoline prices since December 2008, as cheaper crude oil cut costs at the pump, the Energy Department said on Monday.

Japan's Nikkei share average opened down 0.58 percent at 9,406.04 on Tuesday (May 24) after U.S. shares closed at their lowest level in a month on worries over recent weakness in global manufacturing.

(Reuters, May 24, 2011)

![[image%255B3%255D.png]](http://lh5.ggpht.com/-x-_irOZ8m0c/Td8l5QAYjdI/AAAAAAAAAME/tXPvaWXiPGs/s1600/image%25255B3%25255D.png)

![[image%255B3%255D.png]](http://lh4.ggpht.com/-vACzKIo-lLA/Td8ihKeQdgI/AAAAAAAAAL8/iqYGNZ_9Us0/s1600/image%25255B3%25255D.png)

![[k5ntdjck%255B4%255D.jpg]](http://lh5.ggpht.com/-DKXMq1hOuWI/Td30iGBDmUI/AAAAAAAAEXo/wfwVdtTe6YY/s1600/k5ntdjck%25255B4%25255D.jpg)

![[image%255B3%255D.png]](http://lh4.ggpht.com/-JSVCsJsLV24/Td3Rm5z78vI/AAAAAAAAALs/nG2ldpc-zxQ/s1600/image%25255B3%25255D.png)

![[image[3].png]](http://lh3.ggpht.com/_fOrXdbL-0ow/Tdx_dQy1Z9I/AAAAAAAAALc/_a8ApmZIkwc/s1600/image%5B3%5D.png)